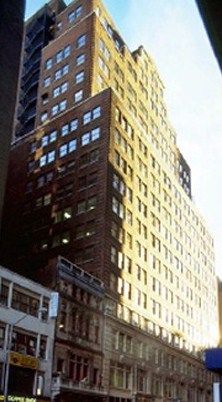

New York (Manhattan) – We have NNN Commercial Real Estate news from Midtown Manhattan. This Commercial Real Estate development is an office tower at 28 West 44th Street, in Midtown Manhattan, is under contract to close soon.. This was not the typical Class A New York Commercial Real Estate development that was highly desirable. However, as we always say with commercial real estate is that it only takes one Buyer. Well this Commercial Real Estate development will be purchased by two commercial real estate investment groups who formed a joint venture (JV). APF Properties and Prudential Real Estate Investors have formed this joint venture to purchase this New York Office Building for $161 million.

SL Green Corporation was the seller of this New York Office Building. The prior owners, Transwestern and commercial real estate management company GVA Williams had hired Janko Rasic Architects to reposition the Property at 28 West 44th Street. In 2001, as part of a multi-million dollar renovation program for this commercial real estate development, Janko Rasic Architects upgraded the common corridors, bathrooms, and designed pre-built office suites of various sizes.

Janko Rasic Architects renovated more than 100,112 square feet of space in this property. The Janko Rasic Architects also renovated the offices of Tenants, such as the law firm Lustig & Brown LLP, and executive training firm Exec/Comm. These renovations were very successful in order for the commercial real estate investors to attract various interested buyers.

SL Green Corporation purchased this New York Class B office building back in in 2005 for the price of $105.5 million. This New York Office Building is approximately 367,112 square-feet of space for net lease Tenants. This New York area in Manhattan is known as Club Row. Although SL Green Corporation has not said directly that this will be a 1031 Exchange deal, it is possible a 1031 Exchange may take place with a New York Commercial Property on Third Avenue. Apparently profits form this commercial real estate sale should be more than $32 Million.

One of the commercial real estate investment groups principals at APF Properties, believes this commercial real estate development fits the criteria of the company’s investment strategy. The commercial real estate investment group is taking advantage of the low interest rate available for Commercial Loans. Also these commercial real estate investors have funds prepared to do more renovations on this New York Commercial Real Estate Development. These plans when completed will increase the commercial property’s NOI (net operating income). Although this property is not an NNN Commercial Real Estate acquisition, with no landlord responsibilities, it can be acquired for a 1031 Exchange replacement property.

The commercial real estate development at 28 West 44th Street was originally opened back in 1919. The commercial real estate development had served as the corporate headquarters for the New Yorker Magazine from the early 1940’s until the year of 1992. Currently this New York Commercial Property is about 86% net leased with some quality Tenants.

This New York commercial real estate development has entrances on 43rd Street and also on 44th Street. Some of the amenities at this commercial property include Tenant controlled air conditioning, a qualified On-site management office, Renovated lobby and common corridors. Some of the top net lease Tenants currently leasing at this commercial property are American National Standards, City University of New York, Crew Cuts, Inc. and eEmerge, NYC.

APF Properties is a fully integrated commercial real estate investment firm with a commercial property portfolio valued at over $500 million. APF Properties was founded with only a mere $750,000 in capital. With those funds, APF Properties acquired its first commercial real estate investment in 1995. Four years later, the commercial real estate investment firm completed a syndication with the purchase of 1156 Avenue of the Americas, in the Midtown Manhattan district.

By 2000, the commercial real estate investment firm had closed its first off-market transaction at 25 West 45th Street in Midtown’s Grand Central submarket. The commercial real estate investment firm broadened its presence in this New York market with the purchase of 1601 Market Street. This trophy property was acquired in 2008.

The commercial real estate investment firm expanded its reach internationally in 2005 with investments in Frankfurt and Berlin, Germany. Also in the first six months of 2006, APF Properties was active with the successful completion of three acquisitions, two 1031 exchange transactions and two CMBS (Commercial mortgage-backed securities) financing transactions. The commercial real estate investment firm has their corporate headquarters in New York City with offices in Philadelphia, Pennsylvania and Frankfurt, Germany.

Search Net Lease Properties in the areas listed below and across the Country.

Here are some of the Retail Single Tenants that may be available as a Net Lease Investment or Triple Net Lease Property:

- 24 Hour Fitness Net Lease Properties

- 7-Eleven Net Lease Properties

- Advance Auto Net Lease Properties

- Ahold Net Lease Properties

- Applebees Net Lease Properties

- Arbys Net Lease Properties

- AutoZone Net Lease Properties

- Burger King Net Lease Properties

- Chick-fil-a Net Lease Properties

- Costco Net Lease Properties

- CVS Net Lease Properties

- Delhaize Net Lease Properties

- Dollar General Net Lease Properties

- Dollar Tree Net Lease Properties

- Dunkin’ Donuts Net Lease Properties

- FedEx Net Lease Properties

- Goodyear Net Lease Properties

- Home Depot Net Lease Properties

- KFC Net Lease Properties

- Kohl’s Net Lease Properties

- Kroger Net Lease Properties

- Lowe’s Net Lease Properties

- McDonald’s Net Lease Properties

- O’reillys Net Lease Properties

- Panera Bread Net Lease Properties

- Pep Boys Net Lease Properties

- Publix Net Lease Properties

- Rite Aid Net Lease Properties

- Safeway Net Lease Properties

- Shell Oil Net Lease Properties

- Staples Net Lease Properties

- Steak-n-Shake Net Lease Properties

- Taco Bell Net Lease Properties

- Target Net Lease Properties

- Verizon Net Lease Properties

- Walgreen’s Net Lease Properties

- WalMart Net Lease Properties

- Wendy’s Net Lease Properties